Jun

United states Agency of Farming (USDA) Financing

First-time homebuyer mortgage programs fundamentally permit people who have reduced or modest revenue or with quicker-than-stellar credit scores to call home part of the brand new Western Fantasy, that’s to state, pick property. Commonly, it is their first household. However, technically, it does not must be. Many apps explain first-time since just not with owned property prior to now about three years. So if you sold your home otherwise it actually was foreclosed to your more three-years in the past, you s described below. Some of these software appeal to particular professions such as those within the the authorities, degree and the military.

Why First-Go out Homebuyer Apps Number

First-go out homebuyer apps help anyone rating reduced-focus mortgages once they are unable to safe them in other places. Since the bodies groups right back all of these funds, certification standards are much less strict than simply he could be to possess antique fund.

If you were to think home ownership is actually for other people and not for you, this informative article will get replace your mind. Continue reading for more information on the most used first-big date homebuyer software.

Federal Homes Management (FHA) Fund

The brand new Federal Construction Administration (FHA) works closely with local loan providers across the country to offer mortgage loans to the people who might not or even meet the requirements. Because the authorities insures portions of those loans, loan providers end up being more comfortable providing mortgage loans to those with no most powerful credit score. Its a powerful solution one of the some basic-go out homebuyers programs.

FHA mortgage degree isn’t as strict with respect to credit rating. Actually, a credit history of around 580 can be considered your for an enthusiastic FHA mortgage which have a 3.5% deposit. Off costs to possess antique mortgages usually hover above 20%. While doing so, FHA loan interest rates dip most less than this new costs for antique finance.

Some lenders wouldn’t even change you aside in case your debt-to-money proportion (DTI) stands all the way to 55%. When the about two years has actually passed because the you have educated bankruptcy, do not has actually a hard time being qualified to own an FHA loan either.

not, it doesn’t mean an enthusiastic FHA mortgage – otherwise any loan for that matter – was a risk-totally free solution, actually funds generated thanks to very first-big date homebuyer software. Due to the fact you’ll likely become and make a small deposit, you will end up required to spend mortgage insurance premiums, new FHA’s particular personal mortgage insurance rates (PMI). These insurance rates can be obtained to guard the lending company but if your standard.

You will also need to pay settlement costs. However, closing costs to have FHA finance tend to be below it are to possess antique mortgages. And you may as opposed to of many antique mortgage loans, FHA finance hold no prepayment punishment. It indicates you could make larger monthly premiums and you can pay off the mortgage early in place of against charge.

It’s also possible to roll-over new initial insurance rates fee and you can off payment towards loan amount. However, you will end up spending a lot more finally. Additionally, you will want to make a deposit to ten% if for example the credit score basins lower than 580. However if you happen to be having difficulty investing initial will set you back, down payment advice programs will help.

And you may instead of multiple antique home loan businesses, FHA-backed lenders allow you to spend settlement costs and you will down costs with present currency. However, make sure the individual giving you this money signs an excellent quick letter describing that he or she will not expect the cash back.

FHA funds normally suit earliest-time homeowners that have troubles securing money elsewhere on account of strict qualification criteria. But sticking with a stronger repayment package may help Americans with lower credit ratings not only repay a mortgage having a great such as for instance ample interest and boost their creditworthiness in the techniques.

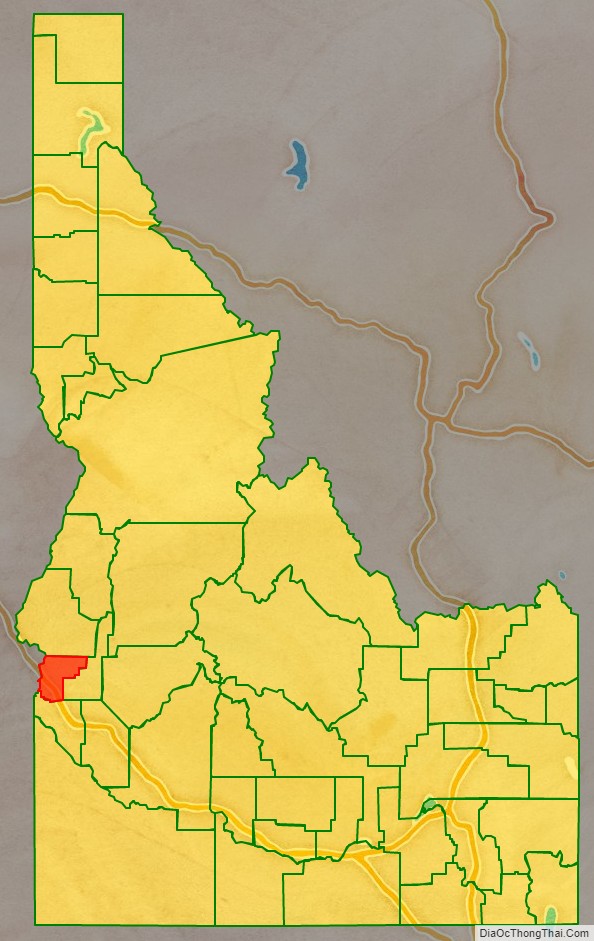

One of many possibilities away from unique first-go out homebuyer applications, the usa Service out of Agriculture (USDA) things low-appeal mortgage loans to reasonable-money Us citizens who want to installment private loans Denver are now living in rural components. But not, the latest USDA generally defines outlying, thus actually specific suburban metropolises be considered.

Leave A Comment